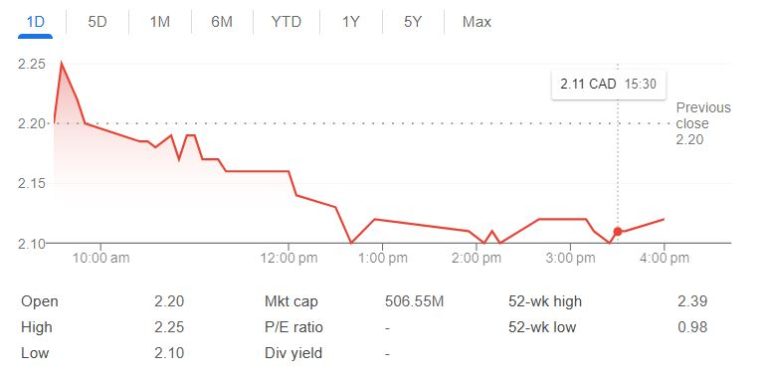

With an eye on high-potential sites, G2 Goldfields Inc. is a Canadian gold exploration business Reflecting a 3.64% daily drop, G2 Goldfields stock is trades at 2.12 CAD. Expanding exploration in Canada and Guyana, G2 Goldfields, with a 506.55 million CAD market valuation, is building gold reserves and drawing investors.

| G2 Goldfields Stock Information | Details |

|---|---|

| Current Stock Price | 2.12 CAD |

| 52-Week High | 2.39 CAD |

| 52-Week Low | 0.98 CAD |

| Market Cap | 506.55 million CAD |

| Headquarters | Toronto, Canada |

| CEO | Denis Laviolette |

| Founded | 2009 |

| Subsidiaries | G3 Gold Inc., Bartica Investments Ltd. |

| More Information | G2 Goldfields – Market Watch |

Focus and Key Projects of G2 Goldfields Exploration

G2 Goldfields works on gold exploration in Guyana and Canada. Its main initiatives are in Guyana, a land with unrealized gold promise. Since G2 Goldfields targets high-potential reserves, their exploration here provides a competitive edge. These projects are seen by investors as fundamental building blocks for next expansion.

Current Stock Price Changes

G2 Goldfields stock has lately displayed some swings. Although presently the stock rests at 2.12 CAD, its 52-week high was 2.39 CAD. Changes in price are connected to internal exploration benchmarks, world demand for gold, and investor interest in gold mining projects. These swings capture the fluid character of exploration stocks.

Main Factors Affecting G2 Goldfields Stock

G2 Goldfields’s stock price is influenced by numerous elements. The value of gold reserves directly depends on its price. Positive results of exploration in Guyana might also inspire investor confidence. Furthermore interesting in new projects are operational benchmarks since successful drilling guarantees the company’s capacity for growth.

Analysts Opinions of G2 Goldfields Stock

G2 Goldfields is seen by market observers with wary hope. Though depending on exploration progress, its emphasis on Guyana’s high-potential gold deposits appeals to me. The stock may get more attention as developments advance. Positive drilling results are expected by analysts to propel gold mining industry stock value.

Risk Associated with G2 Goldfields Stock

G2 Goldfields carries risks, just as other exploration equities. Performance could suffer from project delays, changes in regulations, and changing gold prices. Researching far-off places like Guyana presents logistical difficulties. For those seeking high-return potential, G2 Goldfields could provide an attractive risk-reward mix, nevertheless.

Strategic Alliances and Subsidiaries

Among the companies G2 Goldfields runs are Bartica Investments Ltd. and G3 Gold Inc. These companies help projects spread over several sites, therefore diversifying G2’s portfolio. Emphasizing high-yield assets that improve long-term stock value, this strategy framework allows G2 to allocate resources effectively.

Attaching the Gold Exploration Market

G2 Goldfields distinguishes itself for emphasizing Guyana, a newly developed area for gold mining. Guyana’s reserves are still mostly untapped, which offers G2 special development chances. G2 Goldfields appeals to investors seeking exposure to unexplored gold sources by competing with big mining corporations.

Not Dividend Yield but Growth Oriented

G2 Goldfields reinvests in exploration so it does not now pay dividends. This helps the company to maximize resource development for investors with growth orientation. The reinvestment plan promotes the development of exploration since projects reaching certain benchmarks could result in better stock returns.

Is a good buy G2 Goldfields Stock?

Investors seeking exposure to gold exploration with high growth potential would find G2 Goldfields shares appropriate. G2’s programs and exploration areas have appealing possibilities even if they carry danger. Investors should balance the risks and benefits considering G2’s reliance on effective exploration findings.

Keeping Current on G2 Goldfields Stock

Investors might monitor updates on G2 Goldfields shares through Yahoo Finance, MarketWatch, and Barron’s. Real-time data on market news, project updates, and price helps investors make decisions right away. Managing investments in volatile exploration equities depends mostly on tracking updates.