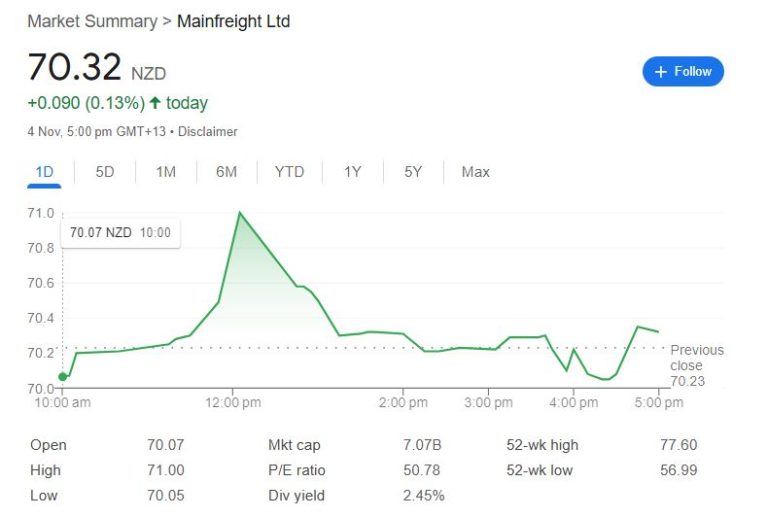

Recently trading at 70.32 NZD was Mainfreight LTD (NZE: MFT). The stock went up 0.13%. Mainfreight, which started in New Zealand, has attracted numerous investors by growing internationally. Leading logistics company New Zealand runs business all throughout Asia, the Americas, Europe, and Australia.

| Attribute | Value |

|---|---|

| Stock Symbol | MFT |

| Market Cap | 7.07 Billion NZD |

| Current Price | 70.32 NZD |

| 52-Week High | 77.60 NZD |

| 52-Week Low | 56.99 NZD |

| P/E Ratio | 50.78 |

| Dividend Yield | 2.45% |

| Day’s Range | 70.05 – 71.00 NZD |

| Average Volume | 46,634 |

| Earnings Date | November 7-11, 2024 |

Consistent Performance & Industry Trends

Over the past year Mainfreight’s share price ranged from 56.99 to 77.60 NZD. The P/E ratio of the company, 50.78, indicates possible development for investors. For income-conscious investors looking for consistent gains, the current dividend yield of 2.45% appeals.

Dividend Strategy Mainfreight

Mainfreight’s consistent dividend payout has attracted interest from investors more concerned with passive income. July 11, 2024 was the most recently occurring ex-dividend date. Mainfreight’s dividend policy appeals mainly to income-oriented portfolios, particularly in the transportation industry, where such yields are rare.

A table summarizing the current market data for Mainfreight Ltd (MFT)

| Market Summary | Details |

|---|---|

| Share Price (NZD) | 70.32 |

| Day Change | +0.090 (0.13%) |

| Market Cap | 7.07B |

| P/E Ratio | 50.78 |

| Dividend Yield | 2.45% |

| 52-Week High (NZD) | 77.60 |

| 52-Week Low (NZD) | 56.99 |

| Day’s Range | 70.05 – 71.00 |

| Open (NZD) | 70.07 |

| High (NZD) | 71.00 |

| Low (NZD) | 70.05 |

| Average Volume | 46,634 |

Global Economic Affect on Logistics

Changes in world economy influence the performance of the logistics sector. The wide market base of Mainfreight lowers the risks connected to region-specific problems. Mainfreight’s worldwide approach offers consistency against market instability as demand in global marketplaces is always changing.

Revenue Increase Through Strategic Development

Originally a little company in Auckland in 1978, Mainfreight grew steadily by acquisition. Its purchases of local logistics businesses in strategic areas have accelerated income growth. Mainfreight has been able to increase its presence using fresh logistical networks across the globe by means of this strategy.

Quarterly Financials Show consistent increase.

Mainfreight recorded an 11.59% revenue gain for the March 2024 quarter to hit 1.18 billion NZD. Rising by 59.84%, net income shows effective cost control techniques. In a high-volume sector, Mainfreight keeps operational efficiency with a net profit margin of 3.56%.

Positioning in Competency Markets

Mainfreight faces rivals in the New Zealand market including Meridian Energy Ltd and EBOS Group LTD. Mainfreight gains a competitive advantage by concentrating on logistics development in important sectors. Its wide worldwide presence sets it apart from domestic-only logistics companies.

Development Plan: Technology and Creativity

Mainfreight seeks to develop technologically, therefore enhancing logistics effectiveness. This technologically driven approach seeks to satisfy the quick demands of worldwide supply chains. Given the growing need for e-commerce, digital transformation is essential to be competitive in worldwide marketplaces.

Stock Variability and Investor Mood

Affected by world logistics trends and economic situations, mainfreight shares have showed modest volatility. Mainfreight’s stock, with a beta of 0.79, varies somewhat relative to the market generally. Investors should take industry susceptibility to changes in world economy into account.

Future Income Report and Expectations

The November 7–11, 2024 Mainfreight earnings report is much under observation by investors. The research is designed to provide insights on Mainfreight’s expansion possibilities and operational practices given growing market demand. Performance measures might show the direction of the stock going forward.

Appreciations and Market Analyst Views

With a one-year aim of 79.52 NZD, Mainfreight reflects a possible expansion potential. Though some warn against excessive valuation levels, analysts remain upbeat. Investors should consider these points of view while tracking the worldwide influence on logistics companies on the economy.

Investment Long Term vs. Short Term

Mainfreight’s consistent growth and high dividends offer opportunity for long-term investment. The modest volatility of the stock could not be appealing to short-term investors. Mainfreight might fit diversified portfolios aiming at consistent development with high returns and an established market position.

Mainfreight is a Strong Buy, therefore

Investors in logistics have a chance with mainfreight shares. Its attraction increases with its substantial worldwide presence and dividend policy. Investors should evaluate Mainfreight’s strategic actions in line with more general economic trends given the uncertainties about the global market.

FAQs

- What is Mainfreight’s stock symbol?

Mainfreight’s stock symbol is MFT. - Where is Mainfreight based?

Mainfreight is based in Auckland, New Zealand. - What is Mainfreight’s current dividend yield?

The dividend yield for Mainfreight is 2.45%. - When is Mainfreight’s next earnings report?

Mainfreight’s earnings report is expected between November 7-11, 2024. - What is Mainfreight’s 52-week high?

Mainfreight’s 52-week high is 77.60 NZD. - What sector does Mainfreight operate in?

Mainfreight operates in the logistics and transportation sector.