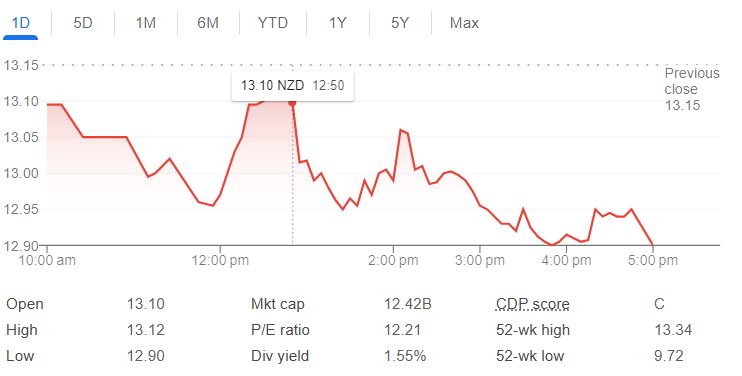

Investors actively watch big New Zealand infrastructure investment company Infratil Limited. Its share price right now is 12.90 NZD, a little drop of 1.90%. These movements appeal to investors particularly considering the company’s involvement in digital infrastructure, healthcare, and renewable energy.

| Infratil Share Price Details | Description |

|---|---|

| Current Share Price | 12.90 NZD |

| 52-Week High | 13.34 NZD (achieved Oct 24, 2024) |

| 52-Week Low | 9.72 NZD |

| Market Cap | 12.42 billion NZD |

| P/E Ratio | 12.21 |

| Dividend Yield | 1.55% |

| Headquarters | Wellington, New Zealand |

| CEO | Jason Boyes (since Apr 1, 2021) |

| More Information | Infratil – Market Watch |

Portfolio of Infratil and Stability of Share Price

From digital infrastructure to renewable energy, Infratil‘s portfolio covers healthcare as well. These industries give the share price stability even in the middle of market swings. Investing in sustainable energy through Manawa Energy gives strength since the demand for clean energy rises globally.

Excellent performance and consistent expansion

Share values from Infratil have demonstrated consistent increase. For instance, a $1,000 2014 investment would today be worth more than $7,000. This expansion emphasizes Infratil’s dedication to high-return industries and good asset management. For consistent capital growth, long-term investors consider Infratil to be a good option.

Recent Share Price Variations

Infratil’s share price has somewhat dropped recently. At 13.34 NZD, its 52-week high; the current price is 12.90 NZD. These swings capture more general market pressures than they do particular corporate problems. Diversification of Infratil helps to lower single-market volatility exposure.

Important Elements Influencing Share Price

Among several things, Infratil’s share price is influenced by digital infrastructure, healthcare assets, and renewable energy. While healthcare assets satisfy growing needs both in New Zealand and outside, providing stability for the share price, the growing interest in renewable energy has enhanced the portfolio.

Dividend Yield and Income Possibilities

Infratil pays a dividend yield of 1.55%. Though small, this yield attracts to those with income-oriented priorities. It shows a sensible strategy, giving shareholder returns first priority along with asset reinvestment. Infratil offers a pleasing income source for investors looking for consistent dividends.

Forecasts & Market Predictions by Analyst

With a projected share price of 12.04 NZD by the end of the quarter, analysts foresee some short-term volatility. As Infratil’s main assets develop over the next year, they forecast modest increase. Its varied portfolio provides a safety net that gives investors comfort even in small declines.

The Part Renewable Energy Plays in Share Performance

The approach of Infratil depends on renewable energy. Under Manawa Energy, these assets fit with worldwide environmental targets. Since demand for clean energy keeps rising in all significant markets, renewable projects help to maintain a constant share price.

International Development and Income Diversification

Investing in New Zealand, Australia, and the US, Infratil spans This regional variety gives the company’s income sources more durability. Through diversifying its markets, Infratil advantages from a rising worldwide need for sustainable infrastructure, so supporting consistent share price increases.

Variations in Infratil’s Share Performance

Particularly in the energy sector, investors should take regulatory developments into account. Economic crises can also affect delayed development and initiatives. Notwithstanding these hazards, Infratil’s approach in varied assets and high-demand industries helps to reduce possible problems to its share price.

Why Infratil Might Interest Long-Term Investors

For investors looking for infrastructure exposure, Infratil provides stability and expansion. The robust portfolio offers consistent profits even though its dividend yield is rather modest. Long-term investors seeking value in the infrastructure industry could find a starting point at the present price level.

FAQs

What does Infratil invest in?

Infratil invests in renewable energy, healthcare, digital infrastructure, and airports.

What is Infratil’s current share price?

Infratil’s current share price is around 12.90 NZD.

Who is the CEO of Infratil?

Jason Boyes has been CEO since April 2021.

What is Infratil’s dividend yield?

Infratil offers a 1.55% dividend yield.

Where is Infratil headquartered?

Infratil’s headquarters are in Wellington, New Zealand.

Where can I check Infratil’s latest stock price?

Check Infratil’s price on Market Watch.