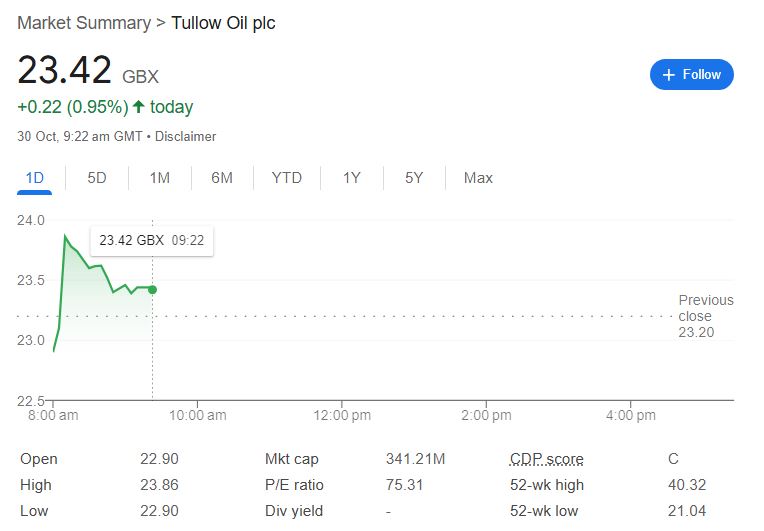

Prominent in oil and gas exploration, Tullow Oil plc is listed on the London Stock Exchange under ticker TLW. Having a market worth of 341.21 million GBX, its share price right now is 23.42 GBX. Investor talks center on its share price swings and possible future performance as oil demand changes.

| Tullow Oil Stock Information | Details |

|---|---|

| Current Share Price | 23.42 GBX |

| 52-Week High | 40.32 GBX |

| 52-Week Low | 21.04 GBX |

| Market Cap | 341.21 million GBX |

| CEO | Rahul Dhir (since Jul 1, 2020) |

| Headquarters | London, United Kingdom |

| Founded | 1985, Tullow, Ireland |

| More Information | Tullow Oil Share Chat – LSE |

Recent Investor Focus and Stock Movement

Over the past year, the share price of Tullow Oil has displayed volatility; highs at 40.32 GBX and lows at 21.04 GBX. The stock trades at 23.42 GBX right now; Tullow’s project advances and worldwide oil price fluctuations show in the price swings. Often reflecting these changes, investor mood fuels conversations about future prospects.

Important Factors Affecting Tullow Oil Price

Global oil prices, production, and exploration results among other things affect Tullow’s share price. While development in areas like Africa impacts investor confidence, oil price swings immediately impact stock value. Every operational milestone draws fresh focus on Tullow’s general energy sector performance.

Tullow Oil Stock Analyst Notes

Regarding Tullow’s future, market analysts are very positive but also wary. Should oil prices level off, they expect possible rebounds. Effective research, especially in Africa, can increase the share price. Still, Tullow stays sensitive to market factors influencing the oil sector given a high P/E ratio of 75.31.

African Projects: Foundations of Tullow’s Strategy

Tullow’s activities in Ghana, Kenya, and Côte d’Ivoire in particular are crucial. Rich in reserves, these areas are fundamental for Tullow’s profits. The worth of the company can increase as research advances. Effective advances could yield significant returns, therefore improving the performance of the stock.

The Risks Tullow Oil Shareholders Face

From oil price volatility to geopolitical concerns in operational areas, Tullow Oil’s shares carry noteworthy risks. Operations in African nations can change depending on policy changes. Any worldwide drop in oil demand affects income, which usually results in stock swings that investors should keep close attention to.

The place of Tullow Oil in the competitive market

Tullow is unique because of its great attention on African high-potential areas. Tullow uses its smaller, nimble posture to investigate underdeveloped areas while facing big oil giants. Its smaller size puts it sensitive to market and price swings, but its localized emphasis distinguishes it.

Dividend Yield and Approach to Growth

Tullow Oil gives projects top priority and does not now pay a dividend. This fits its expansion plan and attracts investors seeking capital growth instead of revenue. As new reserves become available, reinvesting in exploration could help to sustain greater stock value long term.

Investor Feeling and Online Conversations

Investors show different opinions on Tullow Oil in venues including LSE and ADVFN. While some see it as underpriced, others worry about continuous oil sector hazards. Many debates stress the need of tracking oil prices and Tullow’s updates since these elements affect the performance of the company.

The Future Development of Tullow Oil

Good oil prices and effective project completion will determine Tullow’s future growth. Given demand for oil, its emphasis on Africa promises good returns. As these factors influence investor trust, growth will also need negotiating operational difficulties and keeping financing for new initiatives.

Remain Current on Tullow Oil Stock

Platforms like Yahoo Finance, LSE, and ADVFN let investors keep updated on the share price and news of Tullow Oil. Essential for controlling investments in an industry as erratic as oil exploration, real-time data and discussion forums offer insights on market mood and price swings.

FAQs About Tullow Oil Share Price Chat

What is Tullow Oil’s current share price?

Tullow Oil’s share price is around 23.42 GBX.

What factors affect Tullow Oil’s stock price?

Oil prices, production levels, and exploration success impact the price.

Does Tullow Oil pay dividends?

No, Tullow Oil currently reinvests profits into exploration projects.

Where is Tullow Oil based?

Tullow Oil is headquartered in London, United Kingdom.

Who is Tullow Oil’s CEO?

Rahul Dhir has served as CEO since July 2020.

How can I follow Tullow Oil share price discussions?

Track discussions on LSE and ADVFN platforms for real-time insights.